This decade of real estate instability has caused some to question the value of home ownership. Many readers’ parents, grandparents, and even great-grandparents believed home ownership was a savvy financial investment. However, this may only be true when you purchase a property within your budget. Do we all need a four bedroom, three bath 2,500 square foot house? I recommend many people buy their first homes rather than their dream homes and question the status quo. Doing so may become the foundation for their ability to amass generational wealth.

Today, the ill-advised negative amortized and interest-only mortgages are things of the past because of “Qualified Mortgages.” Most buyers will acquire a fixed-rate long-term mortgage. The way these mortgages work is straightforward. Each month, as your payment is received, the lending institution deducts their interest for the loan first, and the second portion reduces the loan’s principal. In the beginning, most of the payments are applied to interest; however, little by little, the two deductions from your payment shift until the loan is paid in full.

Looking at this from another perspective we see the value of our dollar is falling. The value of a Coke from a machine was once a quarter. Today, they are about two dollars and twenty-five cents. This Coke illustration exemplifies “The Time Value of Money.” Today’s money has more purchasing power than tomorrow, a fundamental principle.

So, over time, we dedicate less and less of our income to home ownership when we remain in the property or find a renter to pay the note for us. You should expect to purchase a home like your grandparents for the price they paid for theirs. If the cost-of-living increases by 8% per year and the banks give only 3% for using your money, then you’ve lost 5% of your purchasing power that year. Following are a few other examples of how home ownership is fundamental to wealth accumulation.

The tax law permits homeowners to deduct their mortgage interest paid. The higher the interest, the greater the deduction. During the first year, homeowners may deduct the points paid even if the seller paid them.

Points can be called Origination fees; these fees maybe 1% or higher, which could be a sizable reduction. Tomorrow, when you need more cash flow to start your business and pay for your loved ones’ education, you may utilize a home equity loan. For more on this, the link below has been provided.

Image on the right hand provided by: https://www.pexels.com/photo/white-round-analog-alarm-clock-6863322/ Nataliya Vaitkevich

The Capital Gains Exclusion

If you purchase a property and make it your place of residence for two years, you qualify for an exclusion on the first $250,000 earned when single and $500,000 if married. This exclusion permits you to keep a more significant portion of what the home has appreciated.

In many ways, home ownership is like a forced saving plan when used as designed. A mortgage forces us to save. We also save because, over the years, our mortgage payment will be lower than the cost of renting.

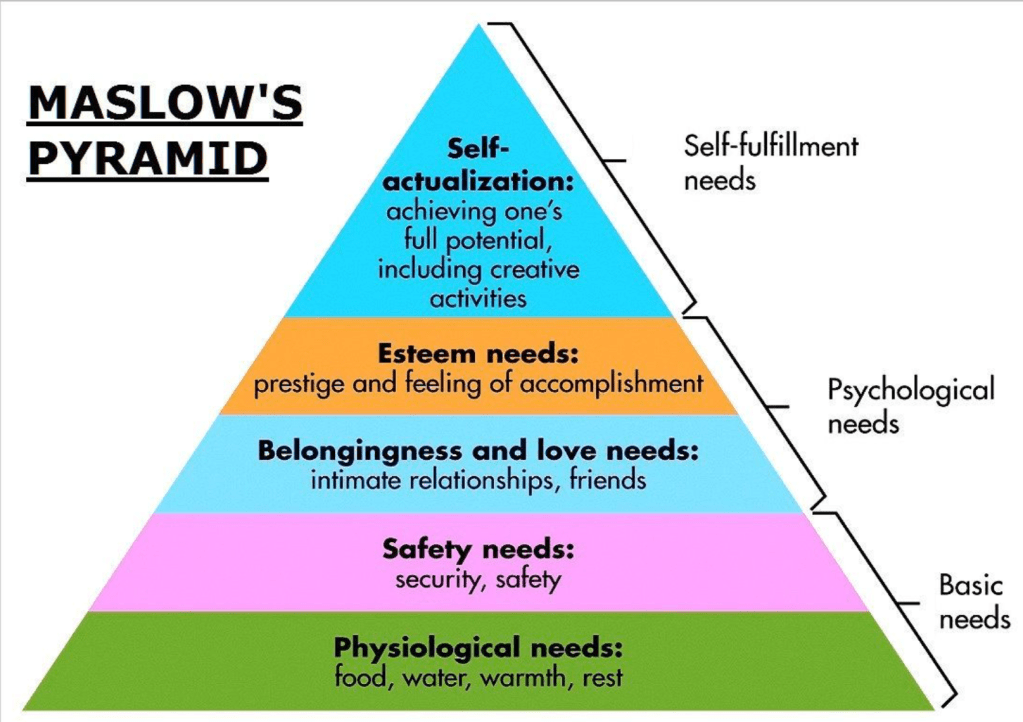

All this being said, the most significant value of home ownership may not be measurable by dollars and cents. According to Maslow’s Hierarchy of Needs, the most essential matter is Psychological.

free image of Maslow’s Hierarchy of needs – Search (bing.com) captured 8/25/2023

Maslow put it into perspective. We must obtain the needs at the base of the triangle before achieving our pinnacle needs.

Leave a comment