Real Estate Markets and Participants

Real Estate values come from interaction of three sectors of our economy:

- The user market (AKA the real world)

- The financial world (capital market)

- And the government

The real world is in completion among its users for physical locations and space. The players in this realm are the potential occupants, both the owner occupant and their renters. The demand for Real Estate come from the need these individuals, firms, or institutions have for convenient access to other locations, as well as their need for shelter, or a place to conduct their activities. About two thirds of house holds in America own their houses, many businesses also own their properties as well, however most commercial real estate in the center business of the U S of A cities is leased.

WWW.federalreserve.gov This site contains extensive information on the U.S. banking system and our Economy

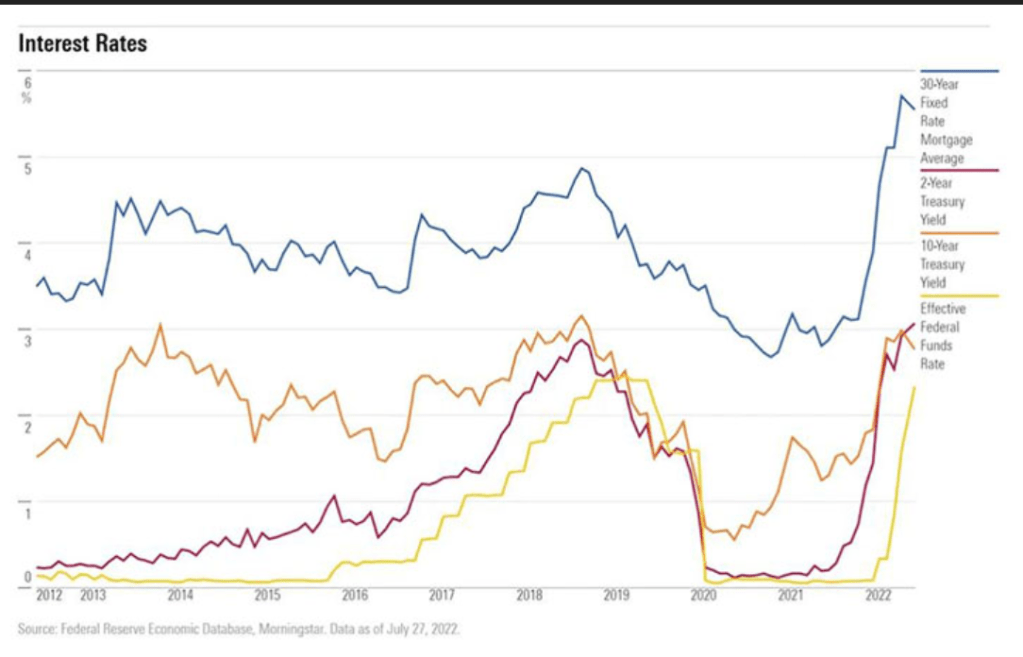

The Capital Markets

The capital market simply refers to the financial resources available to households, firms that need have the need of additional funds. Thus, this market is not entirely Real Estate but it could be for one of the entities requiring additional funds. However, those investing in the capital invest in stocks, bonds, mutual funds, private business enterprises, mortgage contracts, Real Estate. Now with the REIT (Real Estate Investment Trusts) investors can by stock in Real Estate. In theory funds flow from investors to the investment opportunities which yield the highest returns on their investment within tolerance of risk the inverters are willing to take. It doesn’t take much time to calculate the ROI on a stock which you believe is 100% sure is not going to return you investment.

The capital market is divided into two sections:

| Equity interests | Debt interests |

The equity participants are the owners, and they expect to receive a return on their investment A(ROI). These returns can be produced by appreciation, collections of rents, these lenders hold claim to a portion of the interest which borrowers (Individuals, firms or governments).

These two categories can be divided into four groups:

| Private equity | Private Debt |

| Public equity | Private Debt |

Equity is money you own; thus, equity is an asset. Debt is money you owe and is a debit.

Assets put money in your pockets and debits take money out of your pocket.

Banks claim that of home is our biggest asset. In time that is true but when you first acquire a house it is the banks asset and your debit. Banks are the biggest borrowers. They don’t gamble their money they gamble their investor money. If they make unsound decisions then once the government determines they are too big to fail. We bare the burden of bailing them out but receive none of the rewards of having done so. When you purchase a home through a mortgage it is your debit and the bank’s asset.

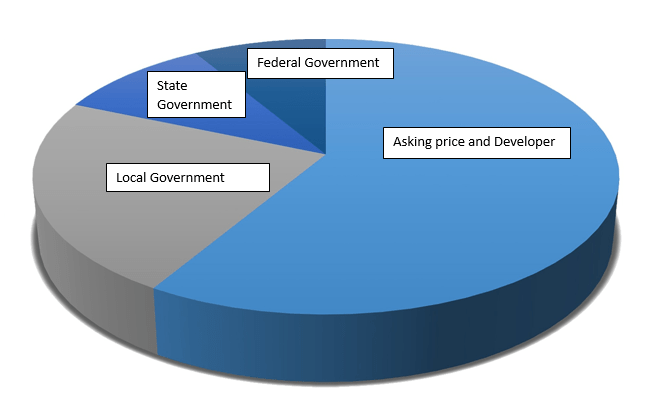

Government Role in the Value of Real Estate

Local government perhaps affects the price of Real Estate the most. It does so through Zoning which affect the supply, and cost. I also use land use regulations, fees on the lands development and building codes, which may restrict the use and construction methods available to be used on the property. There is another method governments affect the cost of Real Estate and that is through taxes. Taxes affect the value of the land in a couple of ways. First, before purchasing a smart investor has performed their due diligence. If they have x amount of funds, they can spend then they should only consider sending X amount of dollars or less. They cannot afford Y therefore in order for that purchaser to purchase the property someone has to lower their cost. The second way taxes affect the value of Real Estate is through the infrastructure improvements. When considering a piece of property a parcel of land alongside a well-traveled paved road is more desirable to a large distribution center than the same size property down a dirt path with no bridges to cross the streams 15 miles from town. The State also has its say in affecting Real Estates value, through build codes. Building Codes affect cost of building. After WWI down town USA was pretty full of store, so in order to entice developers to build our government sweetened the pie for developers if they would build strip malls along busy roads. These projects are not called strip mall because they house a strip of stores. They are called strip mall because they have been striped of some of the regulations down town projects required. Let’s chase a little rabbit.

- The developer saves money because some of the building codes have been laxed.

- The government earns more money because the taxes on improved land is higher.

- The insurance companies earn more money because the risk of loss is greater

- The consumer losses money because the cost of doing business for the owners is greater

- Therefore: the communing public is forced to pay the price for the other players gain and suffer the greatest risk and lost if tragedy were to strike

States also collect fees for their services, such as police, fire departments, schools, transportation systems and social services.

The national government uses Income Tax as a means to affect real Estate prices.

It is through the combining of all these forces that the value of Real Estate can be determined.

If Bob wishes to sell his property for $500,000 then he needs to convince the purchaser who can pay all the other fees and requirements needing to be met and still pay Bob’s Asking price or Bob needs to adjust his price so that they can afford it. If not, then Bob will most likely keep his property. The pie is only so big. Everyone will not be able to get all they want. When Bob adjusts his price the other prices adjust accordingly.

Note: Images on this blog site are from a free source. No image or group of photos are intended to represent the people I serve. I don’t care about race (that is a politically correct term that I do not like because we are all of the same race, the human race. I prefer the term ethnicity), color, religion, sex, gender, marital status, disability, genetic information, national origin, source of income, Veteran or military status, ancestry, citizenship, primary language or immigration status. I am a service provider for all people. If we band together and help one another, we will all rise together.

Joseph Erwin is a real Estate Broker, DRE O2131799 and a CA general contractor #B 696662 he’s a member of the CRMLS and The East Valley Association of Realtors

Leave a comment